By Marketing - IDEALINVENT

(Image credit: Guardian)

Peer-to-Peer Lending is an online loan dissemination method that challenges the approach traditional banking institutions take towards credit lending. Instead of extremely time taking procedures stipulated by a bank or a credit institution, you can easily obtain a loan through the P2P platform online. The platform allows, lenders and borrowers to directly interact and discuss loan terms. Typically, the transactions happen between two individuals.

The growth of the P2P sector is largely due to the fact that alternative lenders are offering innovative and competitively priced loans that are easier to obtain. Filling up a simple online form can make you eligible for a loan in just a matter of hours. The high interest yield is now attracting more and more institutional lenders to this field. P2P platforms are seeing a high influx of traditional lenders who are looking to cash in on the attractive interests that this platform can yield. With the availability of both traditional and alternative lenders on a single platform, the definitions of P2P are changing fast. P2P platforms are now more popularly known as Online Lending Marketplaces.

This marketplace is ideal for small and medium business owners and individuals looking for quick unsecured personal loans. SMB owners need not jump through hoops to get a competitive loan anymore. The lenders on the marketplace make use of algorithms to analyze and predict the financial health of the business. Current cash flow statistics and data on the performance of the business goes a long way in judging the potential of the borrower. The USP of the Marketplace lending model, however, is that borrowers can compare and shop for loans on offer from a variety of lenders. This effectively cuts out on of the major problems faced by lenders and borrowers alike, the search costs. Marketplaces generate revenue by charging a small fee from borrowers who are sanctioned a loan.

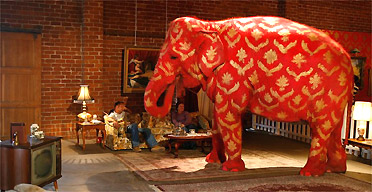

But what about the elephant in the room? When do the regulators step in?

The Online Lending Marketplace has grown leaps and bounds over the past few years. However, it still has a lot of catching up to do. Traditional lending operations still handle an exponentially higher volume of loans. With the rate at which the Marketplace is growing, industry analysts predict that it will be trillion dollar industry by 2025. This kind of extensive growth may come at a price, some analysts fear. Those who advocate regulations argue that with this model SMB's may become the next sub-prime lending crisis if left unchecked. There is also the question of transparency. Lack of a regulatory oversight means that the online lenders may not be accurate and transparent always.

On the contrary, a majority believes that imposing regulations on the Online Lending Marketplace at this stage might stifle innovation and the progress of the model as a whole. The new entrants are popularly being seen as disruptors who are here to replace an inefficient and outdated marketplace. Early and aggressive regulations at this stage will only serve to cut off the innovative access to funding that SMB's are currently relying on. Traditional banking institutions will tell you how strong post-recession regulations have cut their wings. Banks fear that they may no longer have the competitive edge over the new entrants.

The Online Lending Marketplace is crucial to the survival of Small and Medium businesses. It is important to sustain this model by giving it ample space to grow. Post-recession times have seen a great number of opportunities open up. And the way that SMB's can compete in this market is by being able to get access to capital when they need it. Innovation and the onset of technology will continue to drive progress in this field. However, not having any regulations is just as harmful as over aggressive regulation. Any central regulatory body that would take up this responsibility would need to try and strike a balance between the two. The Marketplace needs to be given ample room to grow with just the right amount of oversight and regulation.

Specialist in Financial issues.

ReplyDeleteHello Everybody,

I am Hiu Chun Tiong I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$30,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$30,000.00, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please

contact him tell him that is Hui Chun Tiong that refer you to him. Contact Mr.Lim Koh via email: (lim_koh@yahoo.com.sg)

Mr.Lim Koh

ReplyDeletesuch a informative nice post thanks for sharing. i will share this article in my circle

Business and Finance

Nice to be visiting your blog again, it has been months for me. Well this article that i've been waited for so long. I need this article to complete my assignment in the college, and it has same topic with your article. Thanks, great share. http://www.best-cash-loans.com/

ReplyDeleteI love reading through your blog, I wanted to leave a little comment to support you and wish you a good continuation. Wish you best of luck for all your best efforts. I want to share some information, we provide outsource data entry services in all over the world.

ReplyDeleteBest Virtual Assistant

In the past, it was at banks that people generally sought the funding they needed, but in today's computer and smart phone age, online loans have become the method of funding of the future.

ReplyDeleteguarantor loans

Peer 2 peer investments are increasing day by day and it is being used in many of the banks. So, get the proper unsecured personal loans online from OurMoneyMarket which is the right platform to get loans.

ReplyDeleteThis blog is very beneficial who are looking for the loan for the property purpose. Finding the best suitable mortgage then, singapore mortgage broker will help you in this.

ReplyDeleteThis is a great blog explaining all the details about the online lending marketplaces and the elephant in the room. You can learn all about debt consolidation loan USA for a wide range of projects.

ReplyDeleteWonderful Message for all which you have shared here about Online Marketplaces. This is very informative for those who need this information. In the future share this type of informative article here with us. Top Online Marketplaces for Sellers India

ReplyDeletewatch your favourite pinoy serial in super hd quality Pinoy1 tv to watch full Replay on pinoy teleserye

ReplyDeletebuy online product on treasurebox you can also buy furniture item for your lawn.

ReplyDeleteMoney from your bank to any bank account for free in just a minute through Paytm App and get attractive Cashback offers. You can use Money Transfer Software Development India for a range of services.

ReplyDeleteI read your post and got it quite informative. I couldn't find any knowledge on this matter prior to. I would like to thanks for sharing this article here.How To Get A Same Day Payday Loan

ReplyDeletebeqbe

ReplyDeleterootdown

bucataras

advancedcustomfields

f6s

This article provided me with a wealth of information. The article is both educational and helpful. Thank you for providing this information. Keep up the good work. Equipment Financing For Startups

ReplyDeletePeople find it harder to make ends meet due to rising mortgage rates. When carrying that much weight, you can't take any chances. Make sure you shop around for mortgage rates before you buy anything. Just a handful of lenders can provide the most acceptable mortgage rates and conditions in the business. Mortgage Intelligence is one of the companies that provide these solutions. To acquire the most significant interest rate possible, Mortgage Intelligence is here to assist you. Oshawa is a municipality in the province of Oshawa in the Canadian prairies. Any Oshawa homebuyers who aren't sure what amenities they want in a new residence may be solicited via email.

ReplyDeleteYou are providing good knowledge. It is really helpful and factual information for us and everyone to increase knowledge.about https://www.capitalsecuritybank.com/. Continue sharing your data. Thank you.

ReplyDeleteYou have Shared great content here about Merchant Loans I am glad to discover this post as I found lots of valuable data in your article. Thanks for sharing an article like this.

ReplyDeleteI will prefer this blog because it has much more informative stuff. Visit Non Bank Lender for more related information and knowledge.

ReplyDeleteI'm drawn in by the introduction of this article. It is a really a productive article for us. Continue to post, Thank you.lowest home loan roi USA

ReplyDeleteThis awesome post seems informative and creative. This aided me to enhance my knowledge about Business Acquisition Consulting Services UK. Thanks for sharing the content with a brief explanation.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteNice Post You have shared. itswheon.com

ReplyDeleteYou have given great content here.Migration Skills Assessment Australia I am glad to discover this post as I found lots of valuable data in your article. Thanks for sharing an article like this.

ReplyDeletecheck this kind of article and I found your article which is related to my interest.Super Numb Tattoo Cream Genuinely it is good and instructive information. Thankful to you for sharing an article like this.

ReplyDeleteNice article, very informative.

ReplyDeleteOnline games are becoming popular day by day.

online real money game sites –visit here

Peer-to-Peer lending is definitely changing the way we think about credit. If lenders or borrowers need to handle international paperwork or send materials globally, international cargo services in Lahore offers dependable logistics solutions

ReplyDelete